Weekly Meter

DC / MD / VA / WV

We compare contract activity for the same seven-day period of the previous year in Loudoun County, Prince William County, Northern Virginia, Washington, DC, and Prince George's County. These statistics are updated on a weekly basis. Sign up for our newsletter on the latest market data.

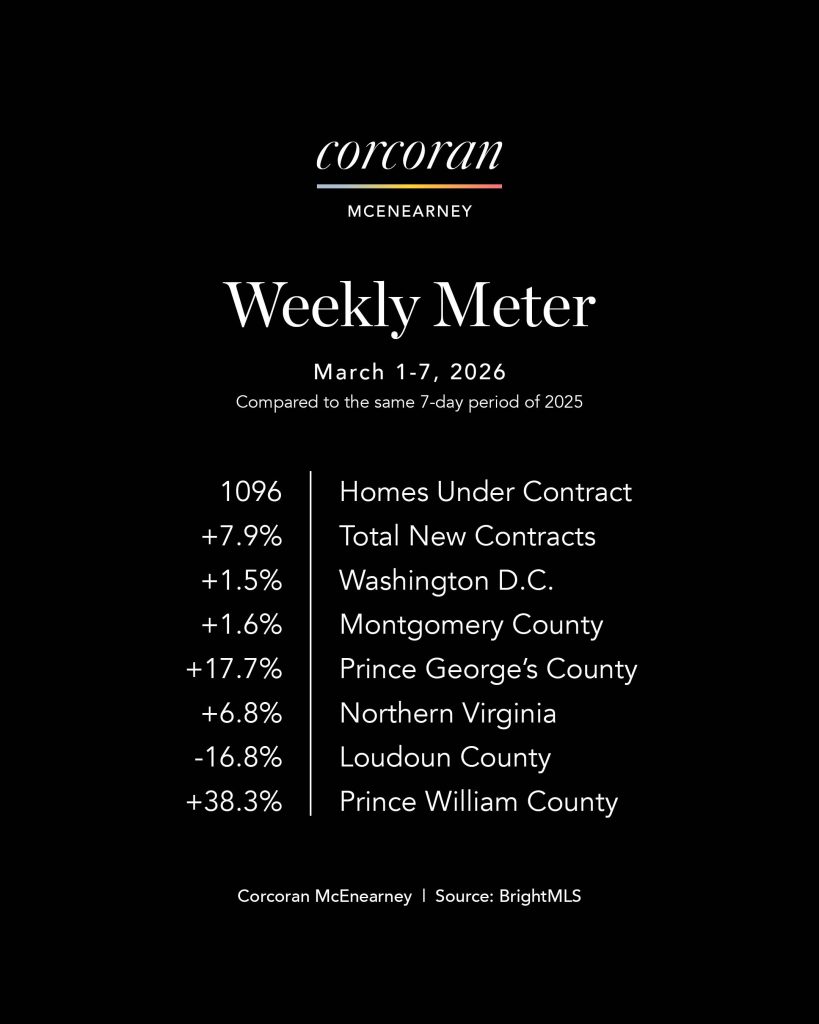

The Thousand-Contract Club (Two Weeks Running)

The Metro DC housing market notched another encouraging milestone last week: newly ratified contracts topped 1,000 for the second consecutive week, a sign that early-spring momentum is beginning to take hold. Overall contract activity across the six jurisdictions we track rose 7.9% compared to the same week last year.

Key Takeaways

- Activity exceeded 1,000 newly ratified contracts for the second week in a row, reinforcing the market’s growing momentum.

- Total contract activity across the region increased 7.9% year over year.

- Five of the six jurisdictions posted gains, with Loudoun County the lone exception, reflecting its continuing inventory shortage.

- The entry-level market (homes under $750,000) continues to lead the recovery, with contracts up 16.5%.

- In contrast, homes priced above $750,000 saw a 5.2% decline in weekly contract activity.

- Average days on market increased from 31 days last year to 36 days this year, though notably, 36 days is the lowest weekly figure we’ve seen so far in 2026

Why It Matters

- Two consecutive weeks above the 1,000-contract mark is a meaningful signal that the spring market is beginning to take shape. Buyers are clearly engaging, particularly in the more affordable segments of the market where demand remains strongest.

- The widening gap between entry-level and higher-priced homes reinforces a broader affordability dynamic. Buyers are responding most quickly where monthly payments remain manageable.

- Meanwhile, the modest increase in days on market confirms a structural shift we’ve been watching for months: buyers are active, but they are taking their time. That dynamic tends to create a healthier and more sustainable market environment.

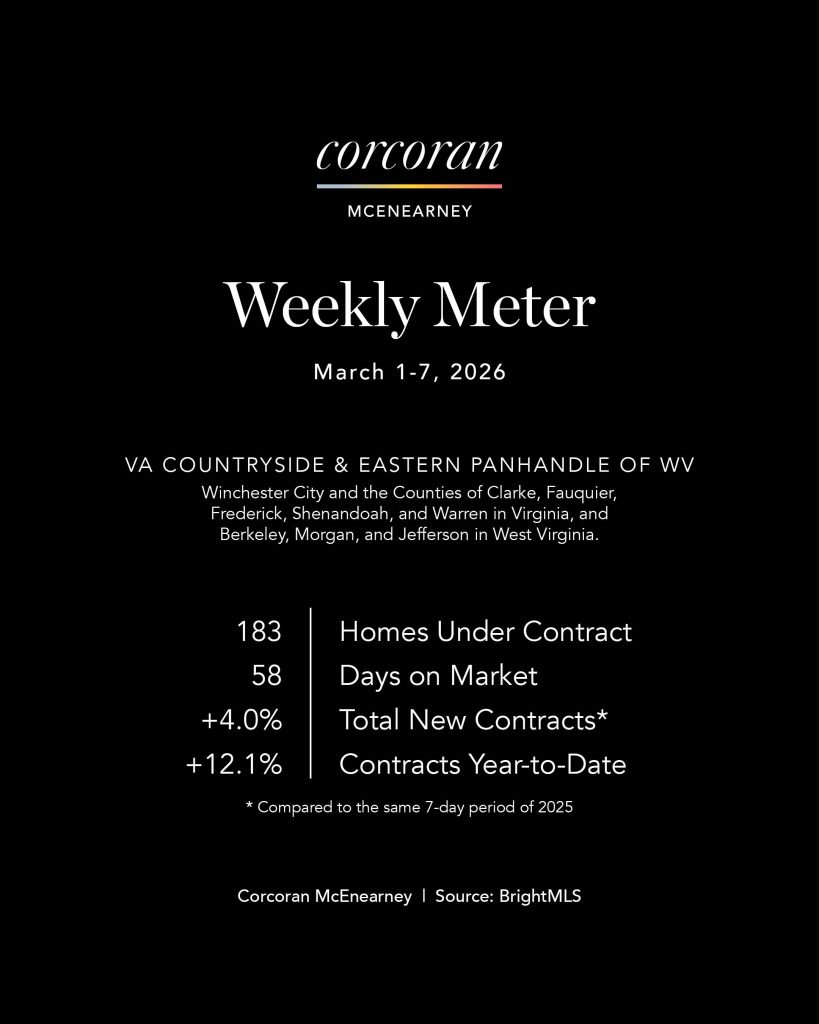

Countryside Keeps Rolling, Panhandle Takes a Breather

The Virginia Countryside and West Virginia Panhandle markets delivered another generally encouraging week of activity, even if the two areas moved at slightly different speeds. Total new contract activity rose 4% year over year, with 183 newly ratified contracts, continuing the steady momentum we’ve seen building through the early part of the year.

Key Takeaways

- Combined contract activity increased 4% compared to the same week last year, with 183 newly ratified contracts.

- The Virginia Countryside led the gain, posting a 12.8% increase in weekly contract activity.

- The West Virginia Panhandle saw a small 3.1% decline for the week but remains up roughly 7% year-to-date.

- The Countryside continues to show impressive momentum, with year-to-date contract activity up 17.3%.

- Average days on market increased modestly to 48 days, compared to 44 days last year.

Why It Matters

- The divergence between the Countryside and Panhandle this week is less about changing demand and more about normal week-to-week variability. The bigger story is the strong year-to-date performance, particularly in the Virginia Countryside where contract activity continues to accelerate.

- At the same time, the modest rise in days on market reflects a broader shift we’re seeing across the region. Buyers remain active, but they are taking a more thoughtful approach — evaluating options carefully rather than rushing into decisions.

- In many ways, this is exactly what a healthy market looks like: steady demand, manageable timelines, and growth that feels sustainable rather than overheated.

The Real Estate Details

- Virginia Countryside: up 12.8% for the week and 17.3% year-to-date

- West Virginia Panhandle: down 3.1% for the week but up about 7% year-to-date

- Total new contracts: 183

- Average days on market: 48 days, up from 44 days last year